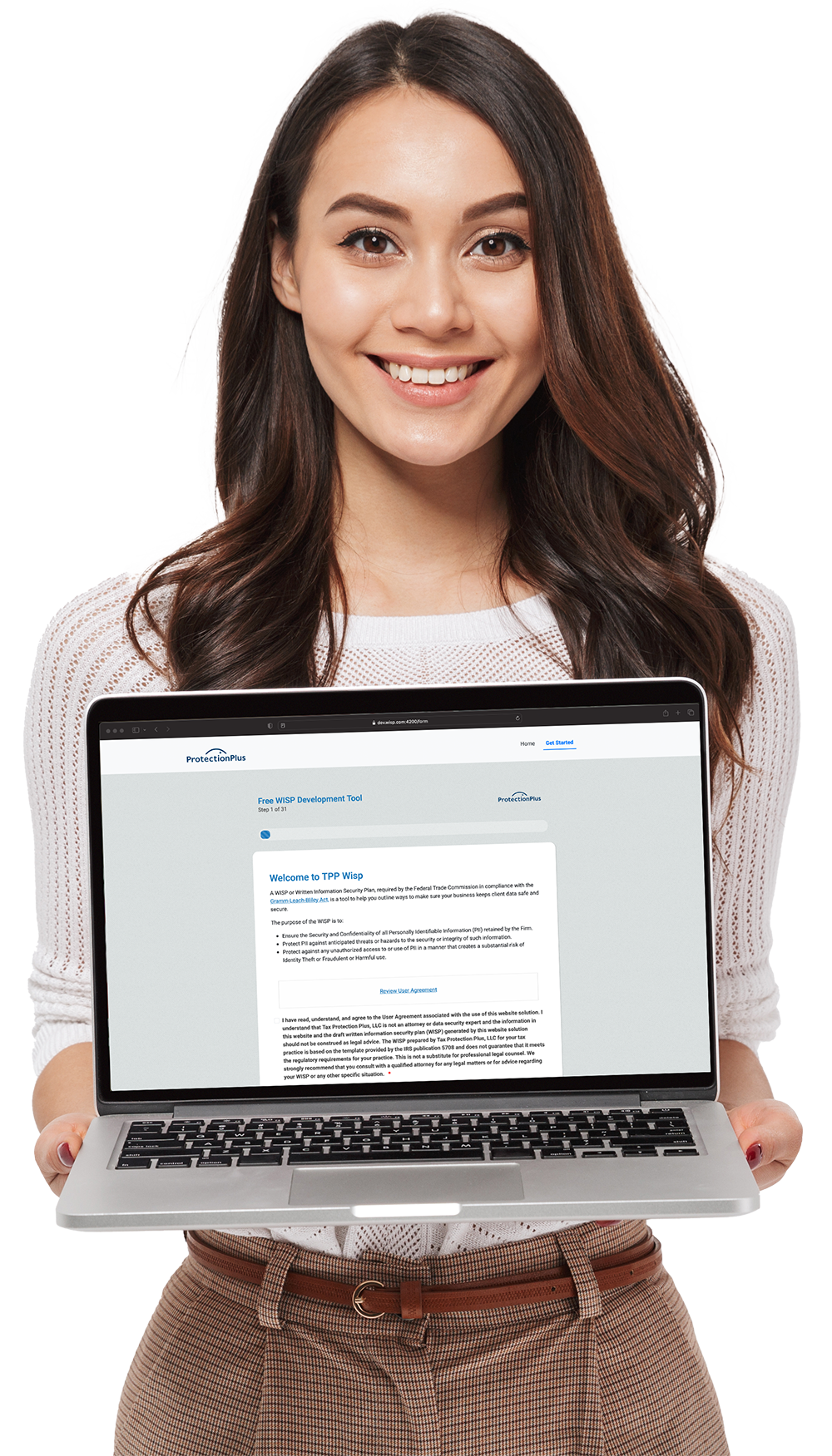

Create a WISP for Your Tax and Accounting Business With Our Free Customizable WISP Template

Creating a Written Information Security Plan (WISP) for your business is easy

with this free step-by-step questionnaire.

Get Started Now!How does the Customizable WISP Template work?

To create your WISP, simply fill out the questionnaire which will walk you through all the critical components of a WISP.

Based on your responses, we'll create a free custom WISP for your tax and accounting business. (The WISP provided is based off the WISP template released in IRS publication 5708)

We suggest that you set aside at least 30 minutes to dedicate to completing the questionnaire.

Why do I need a WISP?

All tax professionals applying for a PTIN are required to create, implement, and maintain a Written Information Security Plan (WISP). This is required under the Gramm-Leach-Bliley Act (GLBA), The Federal Trade Commission’s Safeguards Rule (FTC Safeguards Rule) as well as under IRS publications 4557 and 5708. (IRS Publication 4557) (IRS Publication 5708).

Why are we providing this at no cost?

Protection Plus is the premier tax resolution provider in the tax and accounting industry. We partner with tax professionals to enhance their tax resolution services, promote business growth, and streamline their workflow.

In our many years in the industry, we have seen too many tax businesses fall victim to the effects of a data breach. We believe we have the knowledge and resources to help businesses like yours prepare for the unexpected. That's why we've built this free Customizable WISP Template. It's simply that important.